More profitable than most-- Decoding BCCL, Part II

The company's pre-tax profit margin in 2010-11 was 31.89 per cent. Its financial clout gives it a huge advantage over its rivals, and enables the ToI to establish a strong base in new markets,

says PARANJOY GUHA THAKURTA.

BCCL is one of the most profitable companies of its kind. In the financial year that ended on 31 March 2011, the company earned profit before tax of Rs 1,489.2 crore on a total income of Rs 4,749.3 crore, implying a phenomenally high profit margin of 31.89 per cent. In 2010-11, BCCL earned a net profit of Rs 968.74 crore (20.4 per cent of turnover) -- up by as much as 3.8 times from Rs 252.26 crore in the previous financial year.

(This is the last balance sheet of the company that is available from the Registrar of Companies. It initially had time till the end of September to submit its annual report for the year ended 31 March 2012. However, on 28 September, the Ministry of Corporate Affairs extended the time granted to companies to file their balance sheets and profit and loss accounts in computerized forms that use an extensible business reporting language or XBRL, till 23 December 2012.)

BCCL is not just one of the most profitable companies in the media industry but one of the most profitable companies in the country. “The fact that the company is losing quite a bit on its news television and internet operations and still value-earning huge overall profits is an indication how profitable its print operations are,” observes a BCCL insider who spoke on condition of anonymity.

BCCL’s financial performance compares rather favourably not just with its rivals but with those of some of India’s leading blue-chip corporate entities. Between 2010-11 and 2011-12, for HT Media (publishers of the Hindustan Times and Hindustan), profit before interest and taxes as percentage of turnover or gross revenue fell from 19.3 per cent to 12.9 per cent. For Jagran Prakashan (publishers of Dainik Jagran), the corresponding proportions were 25.5 per cent and 17.6 per cent respectively, while for Wipro the figures were 19.2 per cent and 16.8 per cent and for Reliance Industries Limited, these were 9.7 per cent and 6.7 per cent. Only software major Infosys had profit proportions comparable with those of BCCL: 33.2 per cent in 2010-11 and 32.2 per cent in 2011-12.

BCCL has investments in non-media companies as well. More than a decade ago, it had attempted to run a bank (Times Bank) and provide financial services (through Times Guaranty) but the former was taken over by HDFC (formerly Housing Development and Finance Corporation) Bank in 2000. BCCL continued as the second largest shareholder in HDFC Bank. In July 2009, BCCL picked up a stake (less than one per cent) in Lavasa Corporation (of the Hindustan Construction Company or HCC group) which is developing a hill city on the Western Ghats between Mumbai and Pune – not surprisingly, large full-page advertisements of the Lavasa project frequently appear on the pages of the ToI.

Financial Analysis:

In the analysis that follows, it is important to note that BCCL had closed its books of accounts on 31 July 2008. Thereafter, the next three financial years ended on 31 March each year in 2009, 2010 and 2011. The Companies Act, 1956, permits books of accounts to be closed at any time during the year provided the accounting period does not exceed 18 months. The Income Tax Act, 1961, states that for the purpose of taxation, every company has to close its book on 31 March for a period not exceeding 12 months. In exceptional situations, the 12-month accounting rule under the Income Tax Act can be relaxed. If a company chooses to close books on a date other than 31 March, it has to maintain another set of accounts for the purpose of payment of corporate income tax. Most companies end their accounting on 31 March as they find it expensive and cumbersome to maintain two sets of accounts.

In the case of BCCL, its balance sheet for the year ended 31 July 2008 states in Point 7(a) in the “Notes to Accounts” that the “previous year” of the company for income tax assessment purposes is the financial year between 1 April 2008 and 31 March 2009, that provision for income tax has been made on the basis of the “cash system of accounting” for the said “previous year”. The profits relating to the period between 1 April 2009 and 31 July 2009 along with the period of eight months ending 31 March 2010 would be assessable for tax in the assessment year 2010-11 relevant to the previous year ending 31 March 2010 and therefore “provision for taxation, if any, for this period will be considered in the following year”.

For BCCL, 2010-11 was a good year, despite a more than one-fifth (21 per cent) increase in newsprint costs. The company earned a pre-tax profit of Rs 1,489.14 crore in 2010-11, more than two and a half times higher than the Rs 573.90 crore earned in 2009-10. Its reserves and surplus went up 15 per cent to Rs 5,410.50 crore from Rs 4,716.83 crore in the previous year. Its cash bank balances stood at Rs 220.00 crore, 43 per cent higher than Rs 153.64 crore in the previous year. The company made a provision for taxation of Rs 514.35 crore in 2010-11, a sharp rise from Rs 187.30 crore in the previous year. However, provision for taxes for earlier years fell from Rs 134.34 in 2009-10 to only Rs 6.05 crore the following year.

The group recorded a 24 per cent growth in terms of revenue in 2010-11, surpassing the overall 15 per cent rate of growth of the print market in India (as per a report prepared by KPMG for the Federation of Indian Chambers of Commerce and Industry or FICCI). Despite these impressive results, BCCL’s directors were cautious as they foresaw increased competitive pressures from available alternatives, stagnant readership holding advertisement rates down, and the adverse impact of inflation. The company’s management claimed that in the future, it would focus on expanding its digital ventures, its home video segment and its rights management business to create, build, licence and acquire music and film- related intellectual properties.

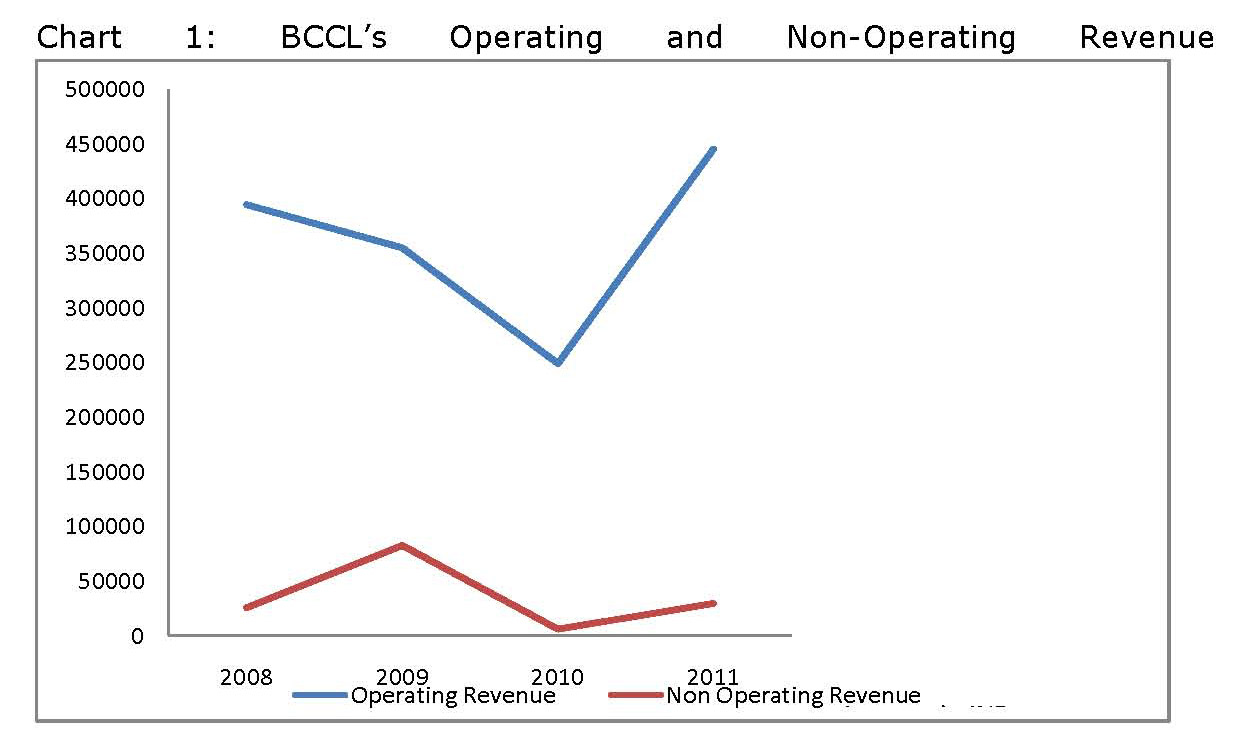

A look at the company’s revenues indicates that revenue from operations – which includes sales of publications, sales of “leisure and retail” products, advertisements, sales of waste paper and telecasting rights – is substantially higher than its non-operating income, that is, income from dividends, rents, business transfers and asset sales (see Chart 1). Sales of leisure and retail products accounted for Rs 19 crore in 2010-11: these could include goods obtained on barter in lieu of advertising such as consumer durables (cameras, mobile phones, household gadgets), music and film discs and so on. Whereas operating revenues are strong enough to sustain the company, these figures to a certain extent underplay the financial prowess of the BCCL.

Revenue from advertising as a proportion of net operating revenue fell from 86 per cent in 2009-10 to 84 per cent in the following year. The fact that BCCL’s “other income” during 2010-11 aggregated Rs 296.76 crore against Rs 374.21 crore earned as revenue from sale of publications, implies that the company can theoretically distribute its newspapers free of charge and still earn handsome profits. This kind of financial clout gives the company a huge advantage over its rivals, including papers like the DNA (Daily News & Analysis) in Mumbai. This also enables the ToI to expeditiously establish a strong base in new markets.

As R. Jagadeeshwara Rao pointed out in an article in thehoot.org published on 29 September 2012, the ToI advertised that its Visakhapatnam edition would be priced at Re one. The low price would enable the paper to compete effectively against its competitors, The Hindu, Deccan Chronicle and New Indian Express. He recalled how the entry of the ToI in various cities in southern India invariably resulted in a fall in the prices of all newspapers. In fact, a similar strategy had been deployed by BCCL in other parts of India as well right through the 1980s and 1990s. The company has invariably unleashed what its competitors call a “price war” resulting in the prices of all newspapers coming down.

Those at the receiving end have cribbed that the ToI is engaged in “predatory pricing” (though not necessarily in the legal sense of the term as per competition law) while BCCL has gloated at the discomfiture of its rivals and argued that its ability to reduce newspaper prices was benefiting readers and enlarging the market. It was not just by slashing cover prices that the ToI would scorch its rivals – attractive subscription schemes with gifts would be used to entice subscribers. In Vizag, for instance, for an initial monthly subscription of Rs 49 and a “gift”, a prospective subscriber would get the daily “almost free”. This could be converted into an annual subscription by paying an additional Rs.300, making the cover price less than Re one a day. A similar strategy has reportedly been planned for Vijaywada, the “commercial and business capital’ of Andhra Pradesh. By way of contrast, leading Telugu dailies like Eenadu, Saakshi and Andhra Jyothi are all priced at Rs 3 a copy.

As already stated, BCCL has 63 subsidiary companies, many of which are in financial services and in real estate, While these holdings are listed in the “statement pursuant to section 212 of the Companies Act” which is a disclosure requirement under the Companies Act, 1956, the true financial picture of the group is poorly reflected in the company’s consolidated balance sheet. In BCCL’s consolidated balance sheet, the aggregate profits and/or losses of the subsidiary companies in both the year under review as well as in previous years are not dealt with in the accounts of the holding company. The company’s balance sheet primarily focuses on the company’s income generated from media operations and only minimal or compliance oriented information on “other income” is made available.

The schedules to the profit and loss account detail publication profits only and the company’s investments that are listed in the balance sheet’s schedule do not reflect individual market values of the shares held. Only a consolidated figure is provided. The schedule to “loans and advances” reveals that loans to “others” who/which are not subsidiary companies have been pledged for shares worth Rs 37 crore. Who these “others” are, have not been disclosed. Thus, while BCCL has complied with the legal provisions of the Companies Act, the objective of transparency has been compromised. If BCCL was a publicly listed company (which it is not), it would probably not have been allowed to get away with such perfunctory disclosure of the financial positions of its subsidiary companies.

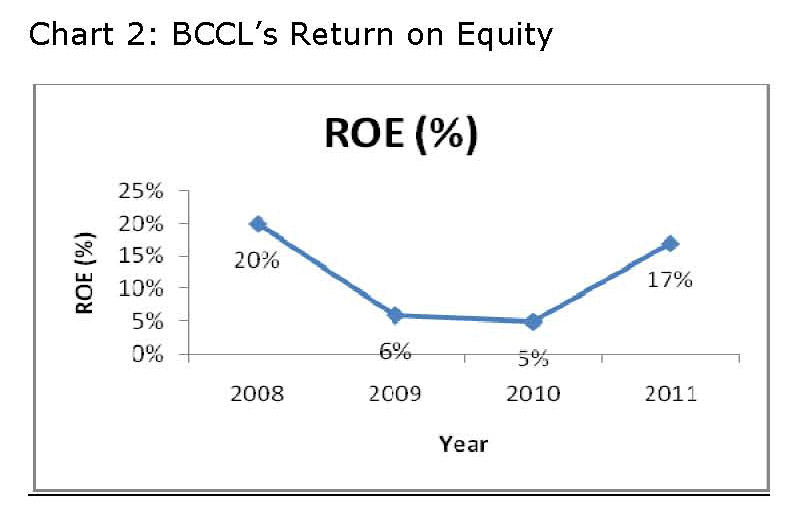

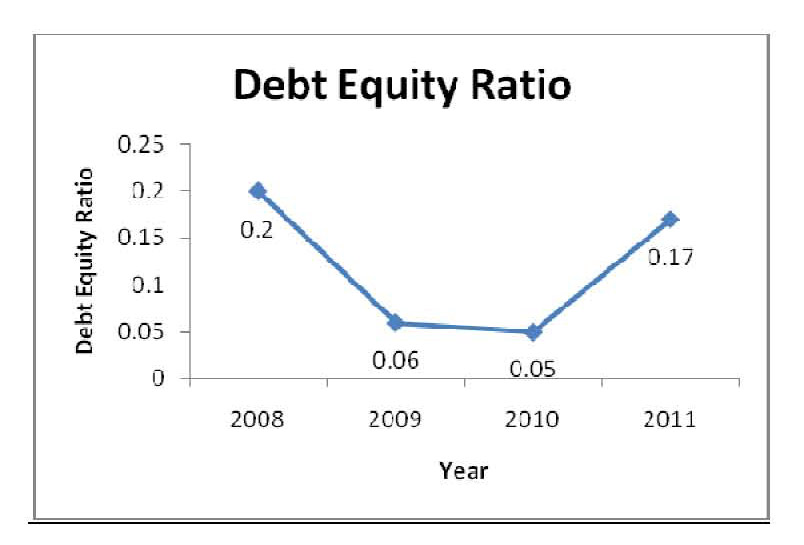

Return on equity (ROE) is calculated as net income divided by total equity. BCCL’s ROE, which stood at 20 per cent in 2007-08, came crashing down to 6 per cent and 5 per cent in 2008-09 and 2009-10 respectively, before rising again to 17 per cent the following year (see Chart 2). Since the company earns most of its revenues from its operations and relatively little in the form of “other income”, including income from its shareholdings in other companies – more on BCCL’s “private treaties” a little later – the fluctuations in BCCL’s ROE are significant.

How does one explain the sharp fall in the company’s ROE for two years during a period when India’s stock-market indices were particularly depressed after touching a peak in January 2008? One explanation could be that the shares held by BCCL in various companies (that it had obtained in exchange for giving out advertising space as part of its “private treaties” scheme) failed to generate anticipated revenues in view of poor conditions prevailing in the country’s financial markets. The second explanation could be that during this phase of an economic slowdown – recession is still a dirty word in India! – the rate of growth of BCCL’s advertising revenue decelerated. It is, of course, possible and likely that both these considerations played a role in BCCL’s ROE careening and rising.

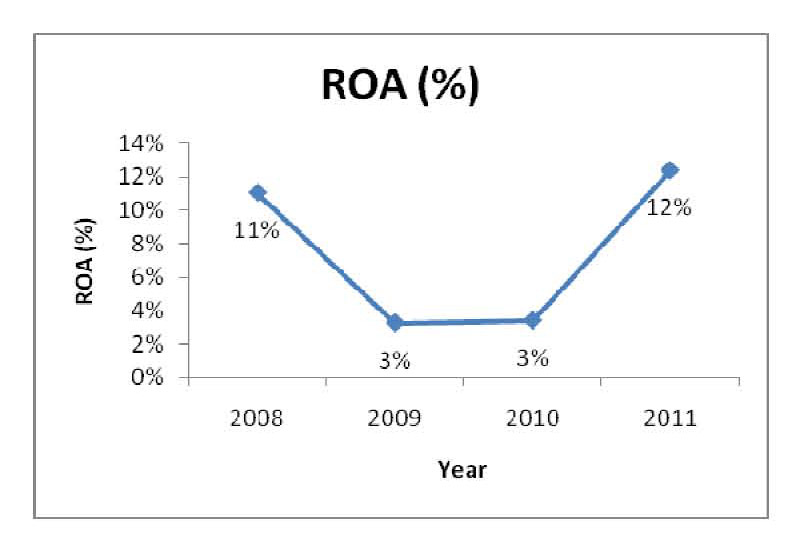

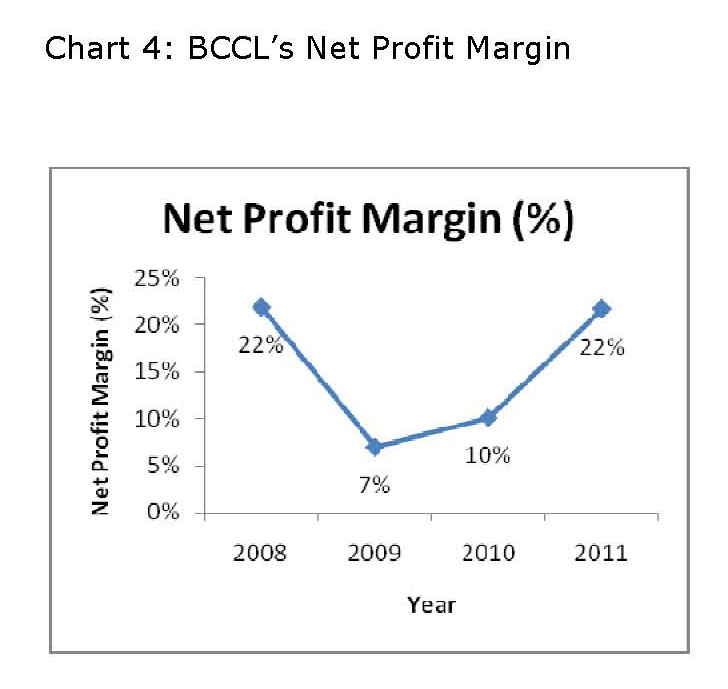

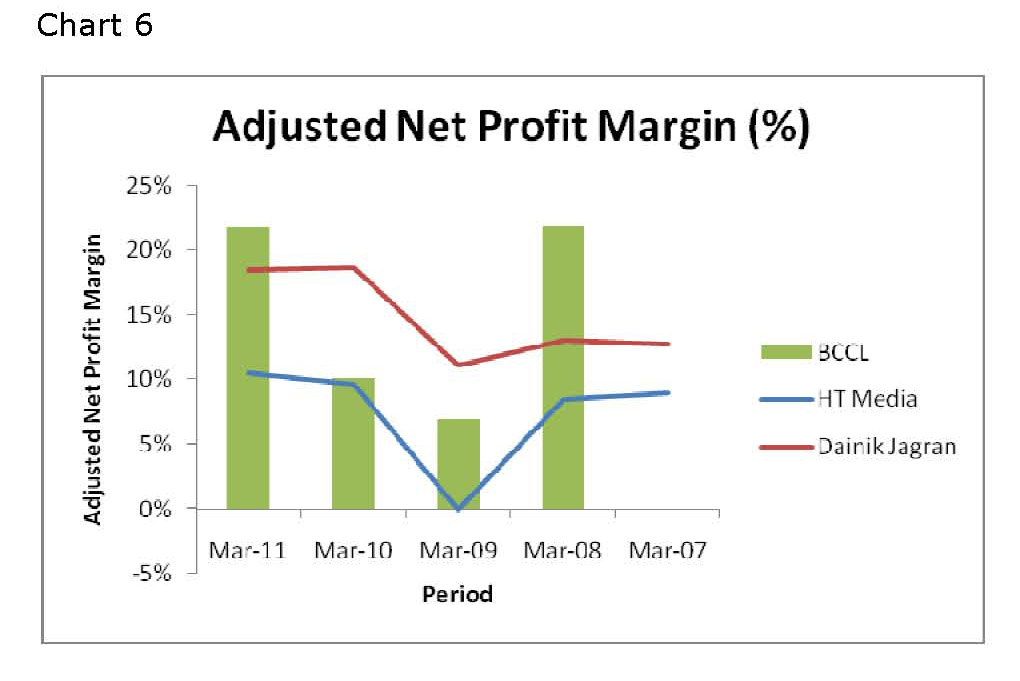

The story gets repeated in the case of the company’s return on assets or ROA which is calculated as net income divided by total assets. BCCL’s ROA slumped from 11 per cent in 2007-08 to 3 per cent over the next two years before rising to 12 per cent in 2010-11 (see Chart 3). The same trend is observed when one calculates the company’s net profit margin -- which is net income as a proportion of net sales. This proportion, which fell from 22 per cent in 2007-08 to 7 per cent in 2008-09, rose marginally to 10 per cent the following year before returning to the level of 22 per cent in 2010-11. It needs to be noted that in the case of BCCL, while its revenue has been significantly impacted by market conditions, the increase in the company’s expenditure has been substantial as well. Newsprint costs, considered to be the single largest item in the chart of costs incurred by the company, have had a major negative impact on the company’s profit margin (see section on newsprint costs that comes later).

Chart 3: BCCL’s Return on Assets

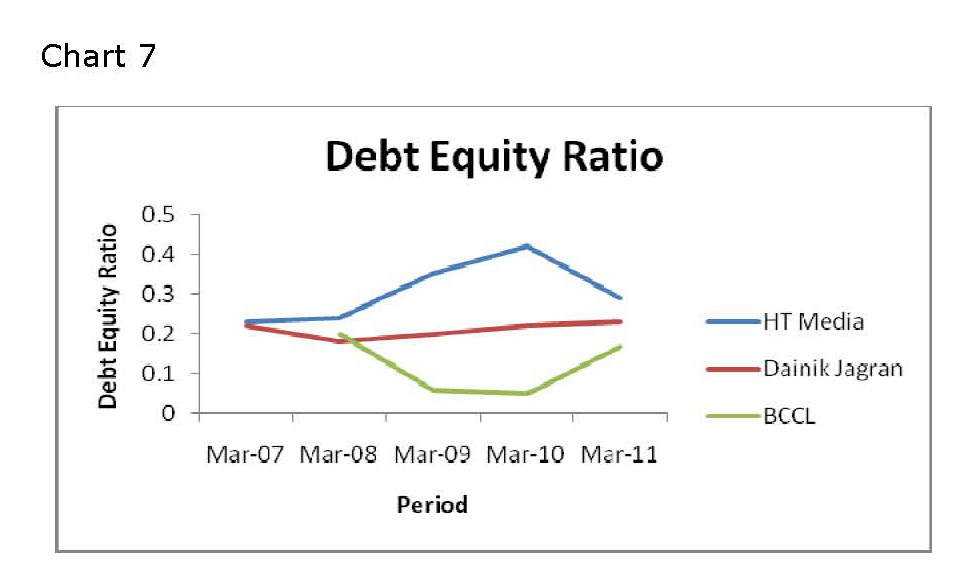

A company’s debt equity ratio is calculated as the ratio between total debt (including secured and unsecured loans) and equity (shares and free reserves). This ratio provides a relative picture between long term debt and equity capital, thereby indicating the financial leverage of a company. A high debt equity ratio typically signifies high use of debt capital which exposes a company to higher risks of debt servicing and interest rate volatility. There is no ideal debt equity ratio – it varies from industry to industry. The debt equity ratio of BCCL fell between 2007-08 and 2009-10 and then rose (see Chart 5). This can be attributed to the increase in equity capital through an issue of bonus shares which rose to Rs 286.96 crore in 2010-11 from Rs 31.88 crore in the previous year and a fall in debt wherein the company’s secured and unsecured loans become nil in the 2010-11, making BCCL an almost “zero debt” company.

Chart 5: BCCL’s Debt Equity Ratio

Comparing BCCL’s financial performance with those of its competitiors

In terms of profitability, BCCL’s performance is superior to its competitors such as HT Media (publishers of the Hindustan Times and Hindustan) and Jagran Prakashan (publishers of Dainik Jagran, said to be the world’s most widely-circulated multi-edition daily newspaper). Chart 6 shows that 2009 was a year of poor revenue generation for all the three newspaper publishing companies.

Comparing BCCL’s debt equity ratio with that of its competitors, it can be inferred that the company’s financial leverage is considerably lower than those of its market rivals implying a relatively more comfortable risk position.

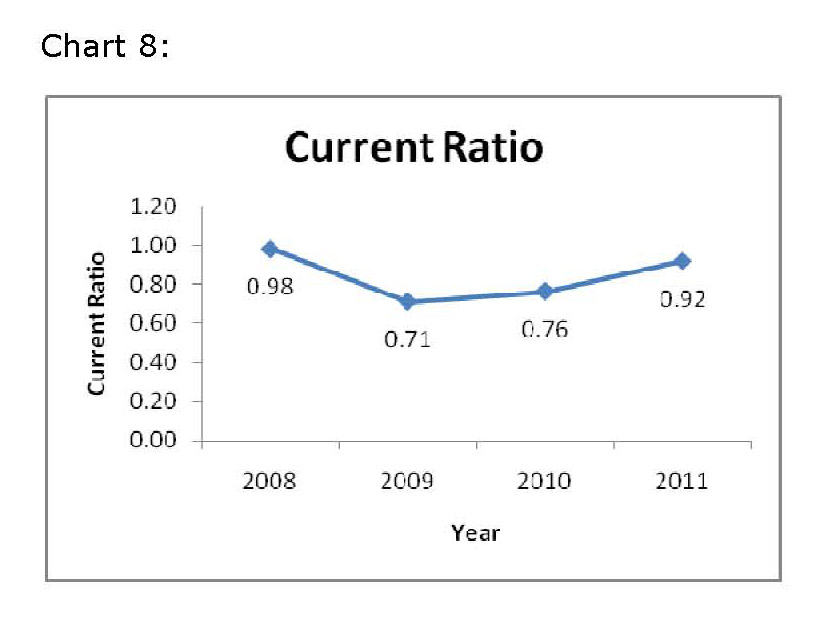

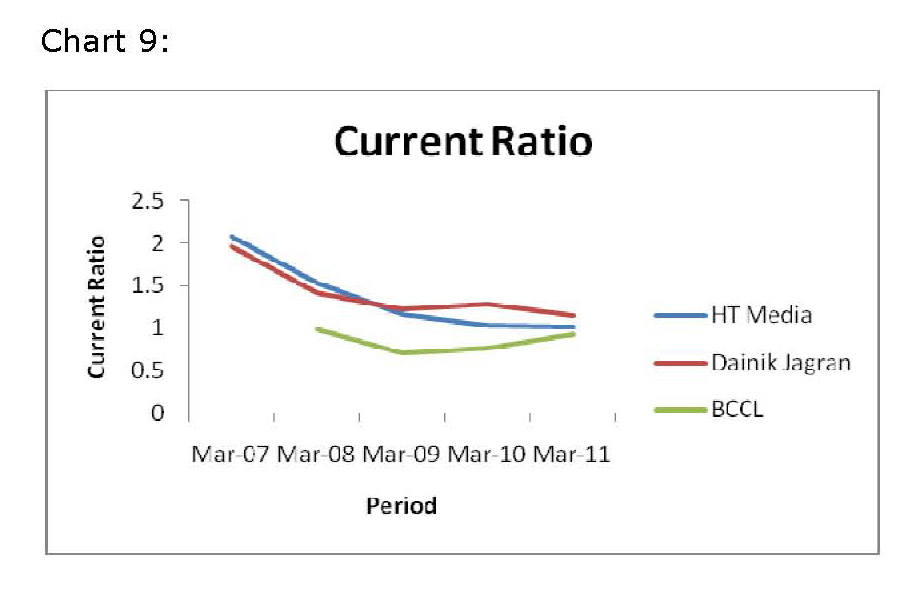

A company’s current ratio is the ratio between the current assets and current liabilities of an organization. It shows the extent to which current liabilities can be covered by current assets, where current assets include cash and other such assets which can be easily converted to cash and short term loans and advances. The ideal current ratio is considered to be 1:2 where the overall current assets are double of current liabilities. But this measure needs to be viewed against industry standards. BCCL has a very low current ratio which signifies higher profitability as fewer funds are deployed in working capital. At the same time, a low current ratio implies a higher risk of default, including default in servicing debt. Chart 9 shows that BCCL’s current ratio has been much lower than its competitors, HT Media and Dainik Jagran, over a four year period.

A low debt equity ratio signifies lower liabilities which include the current liability of debt servicing and interest payment. An increase in BCCL’s current ratio can be attributed to the absence of debt. The company’s adjusted profit margins indicate that while 2008-09 was a year when its profits were squeezed, the recovery that took place over the following two years tells a story. While revenues were constrained and costs went up, BCCL’s profit margins remained by and large unaltered.

BCCL’s establishment costs are much higher than competitors. But given its financial strength, it is able to follow high risk-high return policies. If one considers the fact that 2009-10 was a period of economic slowdown in general – which saw a curtailment of advertising expenditure for the media in particular – BCCL’s accounts indicate that the company management panicked a bit, despite its leadership position. Why? The answer may lie in changes effected to two long-standing advertising policies of the company.

As the market leader, BCCL is one media enterprise that has kept its advertising charges as non-negotiable. In other words, advertisers could not under most circumstances expect a discount on the advertising rates officially specified by the company on its tariff cards. The second factor was that by this period, BCCL’s “private treaties” scheme – or the company accepting shares in lieu of direct cash payments for providing advertising space – was running out of steam for reasons that will be explained.

After many years, during 2009-10, BCCL started offering discounts on its advertising rates. This, on hindsight (which makes us all more intelligent), appears now to have been a myopic and faulty business strategy because when the good times return, BCCL would find it difficult to go back to its old “non-negotiable” advertising tariffs. The challenge to BCCL was not related to circulation or market shares. It had everything to do with depressed stock-market conditions.

Research Assistance: Ahana Banerjee and Purav Goswami

(The writer is Consulting Editor, The Hoot, and an independent journalist and educator with over 35 years of work experience in print, radio, television and documentary cinema. He can be contacted at paranjoy@gmail.com.)

To be continued

Also read: