The DNA of red ink - Part II

Zee Media Corporation got merged with Essel Publishers Pvt Ltd, as cleared by the Bombay High Court on May 2, 2014 with the appointed date of April 1, 2014. Both are Essel Group companies controlled by Subhash Chandra. The scheme was made effective on May 27, 2014 and given effect to in the financial statements for the quarter ended June 30, 2014.

Zee Media issued and allotted 12.23 crore equity shares of Re 1 each to the shareholders of Essel Publishers. Thus, the shareholding of promoter group went up to 69.11 per cent at the end of June 2014, from 53.34 per cent at the end FY (financial year) 2014. Currently, Essel Publishers is the ultimate holding company of Diligent Media Corporation Limited (DMCL) through its wholly-owned subsidiary, Mediavest India Pvt. Ltd. DMCL publishes the English newspaper the DNA (earlier Daily News and Analysis).

The print media business of Zee Media has been housed in three subsidiaries, Mediavest India Pvt Ltd, Diligent Media Corporation Ltd and Pri-Media Services Pvt Ltd. From April 1, 2014, Essel Publishers Private Limited, the ultimate holding company of Diligent Media Corporation merged with Zee Media Corporation Limited and DMCL (DNA’s publishers in Mumbai, Bengaluru and Pune) became an "Indirect Indian subsidiary" of Zee Media by virtue of its 99.99 per cent holding in the entity through Mediavest India Pvt Ltd (a direct Indian subsidiary of Zee Media).

Under the umbrella of the Zee group, Diligent Media published and distributed DNA while another subsidiary of Zee Media, Pri-Media Services Pvt Ltd engaged in printing newspapers and other publications on a "job work basis". As a result, the consolidated operations of the group effective from April 1, 2014 include a new segment: print business.

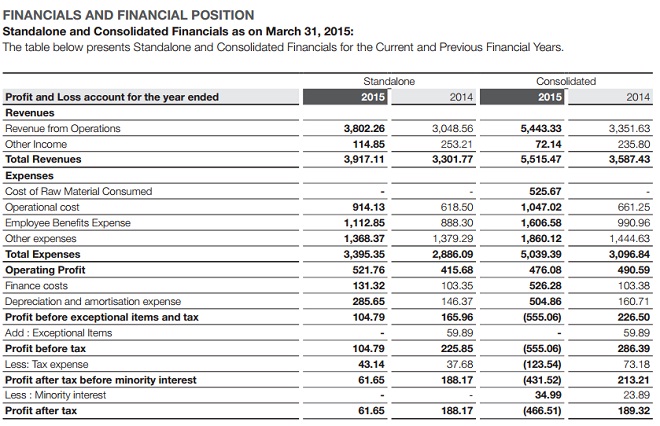

Following the need for "segment reporting" as per Accounting Standard (AS)-17, as on March 31, 2015, the print business segment of the group earned external revenues of Rs122 crore or around 22 per cent of group revenues but incurred losses of Rs 31.88 crore, taking the group’s loss to Rs 46.65 crore, down from a profit of Rs18.93 crore for the year ending March 31, 2014 (as given on pages 143 and 170 of the annual report of Zee Media Corporation Ltd).

Diligent Media (fellow subsidiary of Zee, through Mediavest India), accounted for 48 per cent (Rs 22.5 crore) of the group’s consolidated loss (page 171) The draft letter of offer from Zee Media Corporation Ltd dated January 1, 2015 for eligible equity shareholders of the company points out that in the case of Mediavest India Pvt Ltd, the auditors have qualified their report for the six months ending September 30, 2014. The auditors have pointed out that there had been a diminution in the value of investments in equity shares and share application money paid to its step-down subsidiary, DMCL, aggregating Rs 789.81 crore. This disclosure was made as per the requirements of AS-13 under the head "accounting for investments". The company management considered this diminution in the value of investments as "temporary" in nature.

Had the amount been provided as diminution, the loss for the period and the deficit in the statement of profit and loss would have been higher to that extent. However, no effect was considered in the restated financial information prepared by Mediavest India (page 329 of the draft letter of offer).

Further, Diligent Media’s accumulated losses as on September 30, 2014 aggregating Rs 961.84 crore resulted in the complete erosion of the net worth of the company. The promoter, Mediavest, gave a support letter to bring in funds from time to time to ensure the continuation of operations, and compliance of the official policy on a "going concern". Other concerns and issues have been revealed in the January 2015 draft letter of offer. These include 17 pending civil cases and three cases relating to alleged violation of labour laws against DMCL apart from income tax proceedings for assessment years 2006-07, 2008-09 and 2010-11 (page 420-423) of the draft letter of offer).

Yet the annual report of Zee Media was quite upbeat about its "achievements". It stated: "The DNA, your network’s daily English newspaper for Mumbai, celebrated its 9th anniversary with a special issue and the event, “#dnaturns9,” was trending on Twitter with 28,000 tweets in one day. At least 29 celebrities from film and TV industry endorsed the DNA 'Eco Ganesha campaign', which sought to celebrate big eco ideas solicited from readers. More than 5.2 mn impressions were received for “#dnaEcoGanesha” on digital platform.”

These expressions of "feel good" sentiments hardly tell the whole story. As on March 31, 2015, Zee Media recorded a profit after tax of Rs 6.17 crore, down from Rs 18.82 crore for the previous year. Among subsidiaries, Diligent Media posted a loss of Rs 22.5 crore after a provision of Rs 25.8 crore was made for taxation. The consolidated loss of Zee Media stood at Rs. 46.7 crore, against a profit of Rs 19 crore in FY 2014 (See Table 1) As expected, the relative performance of ZMCL shares suffered.

Zee Media Corporation Limited 2014-15

What then is the bottomline for the newspaper that was conceived with imagination and launched with gusto? The DNA is currently published in Mumbai, Jaipur and Ahmedabad under licence agreements with local publishers. In August 2014 and September 2014, the DNA discontinued its Bangalore and Pune editions respectively. The future of other editions will unfold in the time to come. “We cannot assure that the company shall continue its editions in the other cities where it currently operates.”(pages 22-23 of the draft offer letter).

What goes around comes around. It is ironical that the policy of “price cut”, which was one of the unique selling propositions of the DNA at the time of its launch in 2005, turned out to be a millstone around its neck.

This is what the management has to state: “Competition for circulation and readership has often resulted in competitors of the company reducing the cover-prices of their newspapers and competition for advertising from newspapers has often resulted in competitors of the company reducing advertising rates or offering price incentives to advertising customers. In the event of such price competition, we too may have to reduce the cover price of our newspapers; advertising rates; or offer other price incentives. Any such reduction in prices or rates or the introduction of new price incentives could have a material adverse effect on our results of operations.”

Sudhir Agarwal’s fiesty declarations about wanting “to do in Mumbai what they (ToI) have done elsewhere” hinting at cut-throat price competition, had been responded to in a different context. Vir Sanghvi, then editorial director of the Hindustan Times, had dismissively remarked that the DNA was “a tired retread of ToI’s ideas produced by ex-ToI people” and claimed the paper was not "half as good" as the ToI.

Countering allegations that the DNA’s circulation figures had been artificially inflated to impress advertisers, the management of Zee Media responded: “The advertisement spends by the company’s clients is influenced largely by the circulation and readership of its newspapers, the geographical reach, readership demographics and by the preference of the advertising client for one media over another. …Circulation of the newspapers amongst readers is an important source of revenue of the Company as we earn subscription revenues and sales revenues from the such sale of newspapers. In addition, circulation and readership significantly influence advertising spends by advertisers and advertising rates of the company. Circulation and readership is dependent on the content of newspapers of the company, the reach of its newspapers and the loyalty of its readers of its newspapers”(pages 23-24 of draft letter of offer).

There are numerous references to the "downside risks" in the 500-page draft letter of offer but there is always a "commitment" to ensuring "quality" of news! “Any failure by the company to meet its readers’preferences and quality standards could adversely affect the circulation or readership over time. Circulation in the Mumbai market may be affected if we fail to meet any price competition. A decline in the circulation or readership of the newspapers of the company for any reason could adversely affect the business, results of operations and financial condition of the company”.

To the question of why the seasoned print media giant the Bhaskar group, parted ways from the Zee group, the part answer given by them on record seems to be that the group quit the joint venture because continuing did not make financial sense to them. (see Girish Agarwal’s comments quoted in PartI) Is that the whole answer?

The truth about the working of Diligent Media Corporation, publisher of the DNA, is not easy to find in the dense fine print of company documents that are in the public domain, however "diligently" one scrutinizes them. In fact, the complex corporate holding structures and the maze of transactions -- while not at all uncommon in India -- do nevertheless raise more questions than provide answers as to why the partnership between two of the country's biggest media conglomerates came apart.

Why does Subhash Chandra persist with publishing the DNA despite incurring losses? Is it vanity or simply a matter of getting a tax break? Perhaps the status that comes with being the publisher of a well-produced English language daily is good for this maverick media tycoon's ego, especially if the damage to his purse is relatively little.

The Zee Media annual report for 2014-15 states: “…Because knowing more is crucial for informed decision-making and successful outcomes. Because Every Story matters”.

Maybe the Group persists because they know something we don’t.