Network 18 Part IV--- New owner, new broom

There is a phenomenon that journalists are familiar with when it comes to public sector banks. Every time a new CEO takes over, there is a spike in the level of non-performing assets. It is as though the new CEO scatters loans across Kingfisher Airlines-type borrowers that instantly turn sour!

The phenomenon lends itself to a ready explanation. The new CEO is under no compulsion to continue to keep dodgy assets buried under the carpet where they were put by the previous administration. Cleaning it up would make performance in the first quarter after the new CEO takes over look bad. But in the following quarters things look a lot better as the base period is a washout in financial terms.

Even politics is not immune to this phenomenon. How often have we not heard of a Chief Minister appointee claiming that he/she had inherited a state coffer that is empty?

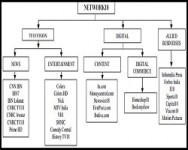

Network 18 proved to be no exception after a new management was put in place, following a reshuffle in the Board of Directors at both the parent company and its subsidiary, TV18 Broadcast, following the exit of Raghav Bahl as Managing Director in July 2014.

In that very financial year (2014-15), the Group wrote off nearly Rs 1,000 crore in losses. To start with, ‘Impairment of goodwill’ (sums paid for acquisition of businesses in the past, over and above the intrinsic value of their net assets) cost over Rs 238 crore.

Diminution in the value of investments resulted in writing off another Rs 143 crore. Loans and advances, customer outstandings, and marking down inventory values cumulatively added another Rs 572 crore in losses. Additional damage came in the form of impairment of the value of tangible and intangible assets at Rs 83 crore, adding up to over Rs 1,000 crore.

A wholesale clean-up

A cleanup of the accounts and balance sheet was not the only change that the new management brought about.The Board of Directors in January 2017 resolved on a wholesale clean-up of the corporate structure involving a number of investment holding companies whose existence added layers to the Group’s operations while delivering little tangible benefit to the activities of the Group.

Accordingly, ten such companies whose business was investing in media and digital businesses were merged with the parent company Network 18 Media & Investments with effect from April 1, 2016.

The advent of the new management also saw improvements in cost ratios. Employee costs, programming expenses, distribution, advertising, and business promotion costs measured as a percentage of the total revenue - all showed a decline in 2015-16. The improvement in the ratio of distribution and of advertising and business promotion costs was particularly impressive. From such costs being 34% of operational revenue in 2012-13, they slid progressively in subsequent years to settle at 25% in 2015-16. Whether this was due to better control over operating costs or that the top line had grown at a faster rate is hard to say. At any rate, the improvement was not sustained in the next financial year.

The media business in general and broadcast in particular can be unpredictable. A marginal dip in ad spends by advertisers can result in wild swings in performance for players at the margin. It is hard for a company that is not the number one player in any particular category or a major geographical segment to hedge against such wide fluctuations in fortunes. Network 18 has still some distance to traverse before it can claim such a leadership position in general entertainment, a key source of revenue.

The results of the just concluded financial year 2016-17 show how quickly profits can be followed by losses. After two years of profits (Rs 29 crore in 2014-15 and Rs 86 crore in 2015-16), the consolidated operations of the Group in 2016-17 resulted in a loss (before tax) of Rs 261.2 crore.

That is a swing for the worse of nearly Rs 350 crore. The management has attributed this to a tepid advertising market in the post-demonetisation phase. But in the absence of a detailed break-up of costs and revenue, which would be available once the annual report for 2016-17 is released, it is difficult to say if other factors also played a part. From the limited data available in the summarised audited results released recently, a few points can be made.

- Network 18 on a stand-alone basis not only continues to struggle, its financial woes have worsened. It is principally engaged in the business of web operations and publishing.

- Losses from the web operations have widened from Rs 20 crore to Rs 28 crore. Its investments in digital media assets have been financed largely from borrowings. Interest costs have increased thus adding an additional burden of Rs 17 crore.

- Miscellaneous income from the sponsorship of events and assorted activities have dropped by over Rs 40 crore.

- TV18 as a broadcasting business on a stand alone basis has been able to hold its own even during what the management has described as a difficult advertising environment in the last quarter. Its profits before tax for the year slipped marginally from Rs 125 crore to Rs 123 crore. Revenue from broadcast operations grew at a slightly lower rate than costs. But since costs are lower in absolute terms than revenues the differential in growth rates between these two did not affect the surplus from broadcast operations as a whole.

- But TV 18 operations when consolidated across joint ventures and associate companies that are into general entertainment and non-business news in regional languages have turned in poorer results in 2016-17. The surplus from operations has fallen by Rs 50 crore from Rs 86 crore to Rs 36 crore.

- Consolidated wage and distribution costs for TV 18 have shot up sharply, with expenditure under both these heads up by another Rs 110 crore.

- Joint ventures and associates directly consolidated with the operations of Network 18 (mostly investment ventures) have contributed to the losses. On a comparative basis their losses have widened by another Rs 50 crore.

It is in moments such as these that having RIL as an owner (75% stake in the parent company) should be of help to the Network 18 Group. What Reliance brings to the table most of all is its ‘deep pockets’ - a welcome attribute in an industry where most players do not have consistent cash flows.

The synergy between RIL and Network 18

While ‘deep pockets’ are welcome, they are not going to be enough. Fatigue can set in from repeated injections of fresh cash, even for the most cash-rich company. But there are synergistic linkages between RIL and Network 18 which hold out greater prospects for enduring the ups and downs of the broadcast business.

In Network 18, with its portfolio of news and general entertainment along with a number of digital assets, RIL has found an adjunct to its mobile telephony business whose USP is its high speed data access delivered on a smart phone.

In theory, Network 18 with its data-rich visual content and its vast library could support the sale of RIL’s fourth generation mobile connections to new customers. So even if the broadcast business does not generate cash, it can be a useful asset to build a subscriber base in mobile telephony. Indeed, RIL alluded to this when it announced its decision to take ownership and management control of the Group, back in 2014.

But it would have still required the confluence of a set of favourable circumstances in the form of past financial profligacy on the part of one (Network 18) and the plans for rolling out a mobile telephony network on the part of the other (RIL) for the two to have come together when they did.

For instance, if Network 18 hadn’t towards the end of 2012 been staring at a potential debt default, not to speak of the complete drying up of fresh working capital to keep operations going, would a deal with RIL have happened at all? Equally, if RIL hadn’t already been stuck with a huge investment in the news and general entertainment business in regional languages (through its stake in the ETV television business) and hadn’t needed a more rounded bouquet of channels to synchronise with its launch of fourth generation mobile telephony, would the deal have happened? Perhaps not.

For RIL, the acquisition of Network 18 Group’s broadcast and digital business assets came at a very attractive price. The entire portfolio of assets together with a stake in the Hindi general entertainment space (Colors) cost the company roughly Rs 1,000 crore in additional funds. The transaction details are as follows.

RIL subscribed to Rs 2,212 crore worth of Zero Coupon Optionally Convertible Debentures issued by the investment companies of the Network 18 promoters. This money was to be used by the investment companies of the Network 18 promoters to subscribe to the Rights issue of equity capital by Network 18. Network 18 in turn used the proceeds of this rights issue to subscribe to its entitlement in the rights issue of equity capital by TV 18.

TV 18’s acquisition spree

And what was TV 18 supposed to do with the money raised from the rights issue? It was to be used principally towards buying out the equity stake in a company called Equator Trading Enterprises (Equator). The shares of Equator were held by a company called Arimas Trading.

TV18 Broadcast’s acquisition of a 100% stake in Equator indirectly gave it control, in varying degrees, over the ownership of three other companies which operated television channels: Panorama, Prism and Eenadu Television.

Panorama owned and operated a bunch of news channels with footprints in Uttar Pradesh, Madhya Pradesh, Rajasthan and Bihar. Since Equator owned 100% of this company, TV18 consequently got complete operational and managerial control over those channels.

Prism in turn owned a clutch of general entertainment channels in Kannada, Bangla, Marathi, Gujarati and Oriya. Equator owned 50% of Prism, and hence TV18 with its acquisition of Equator got a 50% stake in these channels. Finally, the acquisition of Equator also conferred on TV18 a 24.5% stake in ETV Telugu channels for news and general entertainment.

Equator was then 100% owned by a company called Arimas, which got Equator from two other companies, Altitude and Kavindra. Now, Altitude and Kavindra were effectively owned by Reliance Industrial Investments and Holdings, a direct subsidiary of RIL.

In other words, RIL gave money to the investment companies of the Network 18 group to enable it to acquire management control (of varying degrees) in a clutch of regional news and entertainment channels in which RIL had a financial stake and was keen on consolidating with a broadcast company that operated a larger bouquet of channels.

How the acquisitions were financed

The mechanics of actually putting it through were designed through a trust in which RIL had 100% beneficial interest. Independent Media Trust invested Rs 2,212 crore in convertible debt securities of the investment companies controlled by the promoters of Network 18. These promoter companies in turn subscribed to the rights issue of capital by NMIL and through it, the ‘rights’ issue of capital of TV18.

TV18 in turn invested Rs 2,053 crore in equity and convertible debentures of Equator Trading Enterprises, mentioned earlier. Thus, on a marginal cost basis, the first tranche of investment by RIL cost it no more than Rs 159 crore. This was supplemented by a second tranche to buy out the stake held by the investment companies of the promoters which collectively owned shares in NMIL and TV18.

It paid out Rs 707 crore for acquisition of a 100% stake in these companies (thereby getting effective control of NMIL and TV18). It also agreed to take over the loan obligations of these companies which came to another Rs 348 crore.

Altogether the acquisition of a controlling stake in the Network 18 Group came at an incremental investment cost to RIL of Rs 1,214 crore. If the acquisition of broadcast and digital assets has a strategic justification, then the cost is miniscule compared to the overall investment in the mobile telephony business. But whether it adds real value to RIL’s telephony business, or as an independent business valuable in and of itself, is yet to be established.

The fact is that even with a Rs 125 crore net profit in 2015-16, the best performance in recent times, the broadcast business recorded only miniscule profits on a per share basis: Rs 1.13. At the current market price for the company stock of Rs 39.95 (May 5, 2017), investors buying into the company should put up 35 times the unit profit to buy one share.

Given the price-earnings ratios of most other stocks on the market, the Network 18 share is an expensive buy for a retail investor. Especially since the company’s performance in 2016-17 shows that profitability is not guaranteed.

Such concerns are no longer worries for the original promoters. They have made a complete and total exit from the Group, and have money in the bank. All in all, the 74.62 crore shares in NMIL and 6.77 crore held in TV18 by their investment companies cost the RIL affiliates a total of Rs 1,054.02 crore.

Should the loan component in this figure be too added to the purchase consideration given to the promoter individuals? The answer has to be yes, since these individuals were freed from the responsibility of repaying the loans.

But the money that the original promoters retained as residual wealth in their pockets would be Rs 707 crore - less any other loans they had taken personally and were obliged to repay out of the Rs 707 crore.

Not a bad return for an initial investment of Rs 50,000 in promoters’ seed capital, the entrepreneurial flair, hard work and risk-taking of about 15 years, not to mention clever business restructuring, to build, control and eventually hand over a set of broadcast and web-based businesses that the record shows were never secure from financial danger.

* The author is an editorial consultant with The Hindu Business Line.